Stark County Auditor Ensuring Transparency, and Community Growth

The Stark County Auditor Office plays a pivotal role in maintaining the financial integrity and transparency of Stark County, Ohio. As the central hub for the county’s fiscal operations, the office is responsible for a myriad of tasks that ensure the smooth functioning of local government and the equitable treatment of its residents.

Historical Overview of the Stark County Auditor Office

Established in the 19th century, the Stark County Auditor Office has evolved significantly over the decades. Initially, the office’s primary functions were limited to basic bookkeeping and property assessments. However, as the county expanded and its population grew, the responsibilities of the auditor’s office broadened to encompass a wider range of fiscal and administrative duties.

Key Responsibilities of the Stark County Auditor

The Stark County Auditor Office is entrusted with several critical functions:

Property Valuation and Taxation: One of the primary duties of the auditor is to appraise all real estate and personal property within the county. These valuations form the basis for property taxes, which are a significant source of revenue for local schools, municipalities, and other public services. Regular reappraisals ensure that property assessments reflect current market values, promoting fairness and accuracy in taxation.

Financial Reporting and Oversight: The auditor’s office is responsible for maintaining comprehensive financial records for all county departments. This includes overseeing the county’s budget, ensuring that expenditures align with appropriations, and providing transparent financial reports to the public and state authorities.

Licensing and Permits: The office issues various licenses, including dog licenses, vendor licenses, and cigarette permits. By managing these licenses, the auditor’s office helps regulate businesses and activities within the county, ensuring compliance with local and state regulations.

Homestead Exemptions and Tax Reductions: The Stark County Auditor Office administers programs designed to provide tax relief to eligible homeowners, particularly seniors, veterans, and individuals with disabilities. These programs help reduce the financial burden on vulnerable populations, allowing them to maintain homeownership and financial stability.

Recent Developments and Initiatives

In recent years, the Stark County Auditor Office has undertaken several initiatives to enhance its services and address emerging challenges:

Technological Advancements: The office has invested in modernizing its systems to improve efficiency and accessibility. This includes the implementation of online property search tools, digital document management, and electronic filing systems, making it easier for residents to access information and services remotely.

Public Engagement and Education: Recognizing the importance of informed citizens, the auditor’s office has increased efforts to educate the public about property valuations, tax policies, and available exemptions. Workshops, informational brochures, and an updated website provide residents with the resources they need to understand and navigate the county’s fiscal landscape.

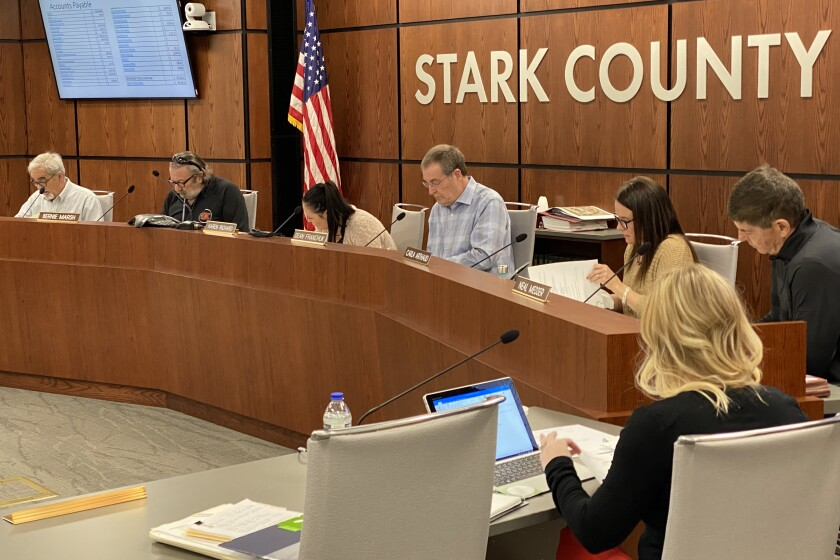

Transparency and Accountability: The office has strengthened its commitment to transparency by providing detailed financial reports and audit findings to the public. Regular audits and open meetings ensure that the auditor’s office remains accountable to the residents of Stark County.

Challenges and Responses

The Stark County Auditor Office faces several challenges in fulfilling its duties:

Property Value Fluctuations: Economic factors can lead to significant changes in property values, affecting tax revenues and assessments. The auditor’s office must continuously monitor market trends and adjust valuations accordingly to maintain fairness and accuracy.

Regulatory Compliance: Staying abreast of changes in state and federal regulations requires ongoing diligence. The auditor’s office must ensure that all procedures and policies comply with current laws to avoid legal issues and maintain public trust.

Resource Constraints: Like many government offices, the auditor’s office operates within budgetary constraints. Efficient resource management is essential to maintain service quality and implement new initiatives without exceeding budget limits.

The Role of the Auditor in Community Development

Beyond its fiscal responsibilities, the Stark County Auditor Office contributes to community development in several ways:

Supporting Economic Growth: Accurate property assessments and transparent financial practices create a stable environment for businesses and investors, fostering economic development within the county.

Enhancing Public Services: By efficiently managing tax revenues, the auditor’s office ensures that funds are available for essential public services such as education, infrastructure, and public safety.

Promoting Equity: Through programs like the homestead exemption, the auditor’s office helps reduce disparities and supports vulnerable populations, contributing to a more equitable community.

Looking Ahead

As Stark County continues to evolve, the auditor’s office remains committed to adapting its services to meet the changing needs of the community. Future plans include further technological enhancements, expanded public outreach efforts, and ongoing improvements in transparency and accountability.

In conclusion, the Stark County Auditor Office serves as a cornerstone of the county’s governance, ensuring fiscal responsibility, transparency, and equitable treatment for all residents. Through its dedicated efforts, the office contributes significantly to the overall well-being and prosperity of Stark County by Stark County Auditor office.

Leave a Comment